If you’re considering hiring a property manager in Seattle, you need to know how fee structures work—and what you’re actually paying for. Most companies charge either a percentage of the monthly rent or a flat fee, but there are also other costs that can impact your bottom line and it’s important to understand what to look for.

This guide breaks down the most common pricing models and additional fees, so you can make a confident, informed decision.

Key Takeaways

- Seattle property management companies charge based on a percentage of the monthly rent or a flat monthly fee.

- Some companies charge setup, vacancy, or maintenance coordination fees, which can significantly impact your total cost.

- A transparent, full-service property manager like SJA Property Management can save you time, reduce stress, and maximize ROI.

How Property Management Fees Work

There are two main ways that property management companies structure their fees: as a percentage of the rent collected or a flat monthly fee. There are pros and cons to both, but the most common structure in the Seattle area is a percentage. Let’s take a look at both structures to see how they work.

Percentage of Monthly Rent

The most common fee structure for property management companies is charging a monthly fee based on the monthly rent. The average percentage in Washington State is between 8% to 12% of the monthly rent collected.

So, if the rent is $2,000 per month, you can expect to pay $160-$240 a month for a property manager.

Fixed Property Management Fee

Some property management companies offer a fixed fee structure instead. Typically, companies charging a fixed fee will set the fee based on a few factors including:

- Type of property: Single-family, condo, duplex, small apartment building.

- Property condition and age: Older buildings may require more oversight.

- Number of units: Multi-unit discounts may apply.

- Location within Seattle: Properties in high-demand areas like Capitol Hill or Queen Anne may be priced differently than those in outlying neighbourhoods.

- Scope of services: Does it only cover the day-to-day operations or also services like leasing, inspections, and evictions.

While there is no hard and fast rule when it comes to setting a fixed fee, you can typically expect to pay between $100 and $250 per month for a single family home. While this might seem like a better deal initially, companies that charge a percentage of the rent are motivated to maximize the rental income for your property.

What Other Fees do Property Managers Charge?

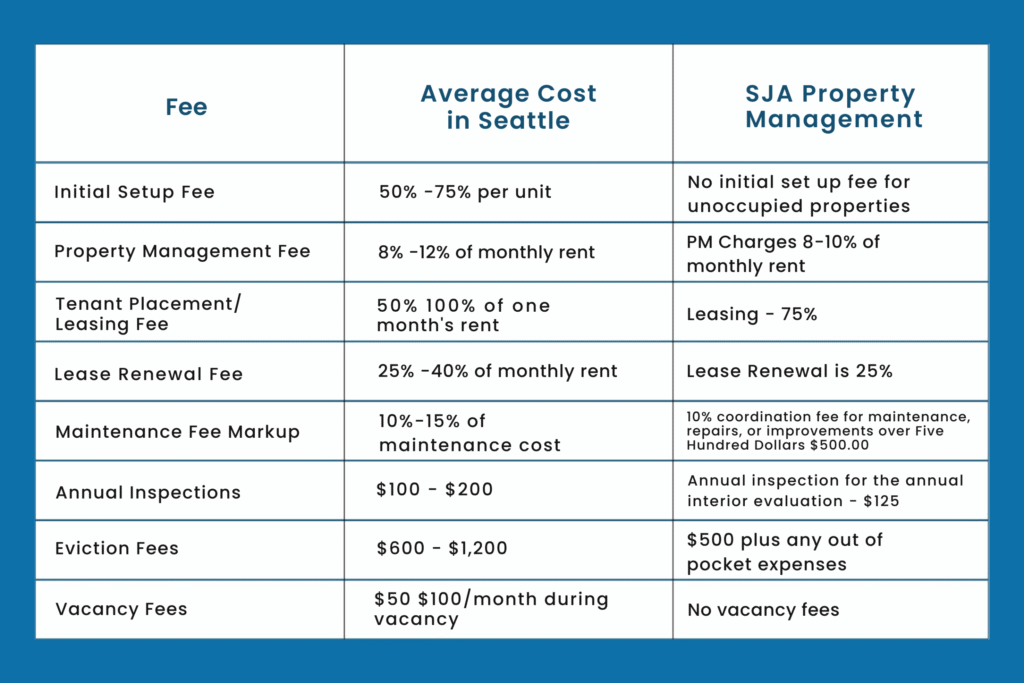

There are other fees associated with property management that need to be considered when budgeting. These fees vary widely between companies, so it’s important to review your management agreement carefully. We’re going to unpack the most common charges you’ll encounter so you’ll know what to look out for.

Tenant Placement or Leasing Fee

A tenant placement or leasing fee is a one-time fee that typically ranges from 50% to 100% of one month’s rent. This fee is used to cover the cost of finding and placing a new tenant. It usually includes:

- Professional listing photography and advertising

- Scheduling and conducting property showings

- Tenant screening (credit, income, background checks)

- Lease preparation and signing

Renewal Fees

When a tenant signs a lease extension, many managers charge a renewal fee, typically between 25% to 40% of monthly rent. This fee covers lease negotiation, updated screening if applicable, and renewal documentation. Not all companies charge this, but it’s a common industry standard in Seattle that you can expect to see from most reputable property management companies.

Maintenance Coordination Fees

Property managers often coordinate repairs and maintenance using third-party vendors. Many charge a markup on vendor invoices (commonly 10%–15%) or a fixed coordination fee per request. This compensates them for sourcing vendors, obtaining quotes, managing repairs, and following up on work orders.

Vacancy Fees

Some property managers charge a fee even when the unit is vacant—either a reduced monthly management fee or a flat fee. This is meant to cover:

- Continued property oversight (e.g., inspections, security checks).

- Utilities management.

- Advertising and marketing costs (if not covered separately).

- Coordination of repairs or cleaning between tenants.

You can expect to pay either $50-$100 per month as a flat fee or 5%-7% of the expected monthly rent.

Occupied Property Setup Fee

An occupied property setup fee is a one-time administrative fee charged when a property manager takes over management of a rental property that already has tenants living in it. Typically, this fee covers:

- Tenant onboarding into the new management system (e.g., collecting lease agreements, deposits, rent schedules).

- Property inspection or walk-through to assess current condition.

- Review and compliance check of the existing lease agreement.

- Communication and transition with current tenants (introducing the new manager, payment methods, maintenance procedures, etc.).

- Data entry and system setup (tenant and property records, accounting setup).

The cost for this varies, but you can expect to pay between $150 and $400 depending on the property and the complexity of the transition.

Setup or Onboarding Fees

When you first hire a property management company in Seattle, it’s standard to pay a one-time setup or onboarding fee. This fee typically ranges from 50% to 75% of the monthly rent. For example, if your property rents for $2,400 per month, the setup fee could be anywhere from $1,200 (at 50%) to $1,800 (at 75%) if charged as a percentage.

Factors that Impact Property Management Costs

Property management fees in Seattle can vary significantly depending on a range of property-specific and market-driven factors. It’s important to understand what influences these costs—it can help you make an informed decision when choosing which management company to work with.

1. Property Type

The type of property being managed will impact the associated property management costs. Single-family homes typically have higher per-unit fees because they require individual attention, whereas multi-family buildings often benefit from volume discounts. Condos or townhomes may involve additional coordination with homeowners’ associations (HOAs), which can increase the cost.

2. Property Size and Condition

Larger properties or homes with multiple bedrooms and bathrooms often cost more to manage due to increased maintenance and tenant needs. Older properties may require more frequent repairs, inspections, and oversight—leading to higher coordination or maintenance-related fees.

3. Location Within Seattle

It’s common for properties in high-demand neighbourhoods like Capitol Hill, Queen Anne, or Ballard may come with higher management fees due to higher rental values and tenant turnover. On the other hand, properties in outlying or lower-demand areas may require more marketing effort, which can also raise fees.

4. Tenant Turnover and Vacancy Rates

When a property has high turnover, it increases the workload for tenant placement, move-out inspections, cleaning, and re-leasing. Property managers may charge more in these cases or include more robust leasing fees. Properties with frequent vacancies may also be subject to vacancy fees or higher advertising costs.

5. Scope of Services Provided

The scope of the services provided will also impact the cost of property management in Seattle. A full-service property management package that includes everything from rent collection, maintenance coordination, inspections, legal compliance, and more, will naturally cost more than a basic rent collection service.

Additionally, add-ons like 24/7 emergency response, routine inspections, or eviction services may be included or billed separately.

6. Rental Price

Some property managers adjust their percentage-based fees based on the monthly rent amount. For higher-end rentals, the percentage may be lower since the dollar value is higher. So, while they may advertise a 15% fee, they may lower it for a property over a certain dollar amount.

Is it Worth Hiring a Property Management Company?

Hiring a property management company isn’t just worth it for property owners—it’s a strategic move that helps maximize rental income, protect your investment, and free up your time.

People often think that managing a property is just collecting rent—some even see it as passive income, but that isn’t accurate. From screening tenants and handling maintenance to navigating Seattle’s evolving rental regulations, self-managed landlords often become overwhelmed or even make expensive mistakes.

A professional property manager can:

- Reduce vacancy periods with effective marketing and tenant screening.

- Handle maintenance promptly and cost-efficiently using vetted vendors.

- Ensure legal compliance, protecting you from fines or legal disputes.

- Provide peace of mind, especially if you’re an out-of-town owner or managing multiple units.

But it is important to find the right property management company, ideally one with local expertise, transparent pricing, and a track record of results.

That’s where SJA Property Management stands out. Our team combines deep knowledge of the local market with responsive, full-service support tailored to your property. Whether you own a single-family home, condo, or a multi-unit building, we offer flexible plans that align with your goals.

Bottom line? If you value your time, want to reduce stress, and are serious about optimizing your rental income, hiring a property management company is well worth it. And if you’re in the Seattle area, SJA Property Management is a smart place to start.

Property Management Costs FAQs

What is the cost of a property manager?

Property managers typically charge between 8% and 12% of the monthly rent, plus additional leaving or service fees depending on the scope of management.

What is most important to a property manager?

The most important priorities for a property manager are maximizing rental income, maintaining the property, ensuring legal compliance, and fostering positive tenant relationships.

What is a reasonable property management fee in Washington?

A reasonable property management fee in Washington ranges from 8% to 10% of the monthly rent, depending on property type, services offered, and location.