Seattle has long been a cultural and technological hub of the Pacific Northwest. Because of this, it is a magnet for renters, and ranks as one of the most expensive cities in the U.S. As the cost of housing, transportation, and daily necessities continues to rise, renters are forced to be more selective about where they live—and what they’re willing to pay.

For rental property owners, understanding Seattle’s cost of living and how it impacts renters is essential.

In this guide, we’ll break down how the cost of living in Seattle is impacting renters and how it affects rental pricing, upgrades, and long-term investment strategies.

Key takeaways

- Seattle’s cost of living is 45% higher than the national average, with housing alone costing over 100% more than the U.S. average.

- Renters are highly cost-conscious in 2025, prioritizing affordability, transit access, and energy-efficient features.

- Utilities, groceries, and services add $1,500–$2,000/month in expenses on top of rent.

Working with a local property management partner can help you price competitively, comply with changing regulations, and improve long-term returns.

How expensive is it to live in Seattle today?

Seattle is one of the most expensive cities in the United States. The cost of living is 8% higher than the state average and 45% higher than the national average in 2025. Seattle is among the most expensive urban centres in the U.S., especially when it comes to housing.

According to recent data, housing costs in Seattle are more than double the national average. Housing costs are 109.3% more expensive than the national average, with monthly rent in Seattle falling between $1,534–$3,948. Essentials like groceries (10.7%+), transportation (30.4%+), and utilities (1.7%+) also carry a premium, further driving up the monthly budget for the average renter.

What’s driving the high cost of living in Seattle?

What is causing the high cost of living in Seattle? There are several factors contributing to the elevated costs:

- The demand for housing is outpacing the supply.

- As the tech industry continues to expand into Seattle, a well-paid workforce willing to pay a premium also expands.

- Seattle’s geography limits buildable land, naturally increasing real estate values.

What this means for rental property owners

The cost of living has a direct impact on how landlords approach pricing strategies, tenant turnover, and long-term returns. A climbing cost of living correlates to more discerning tenants. They’re on the lookout for rental properties that balance affordability, quality, and convenience.

To stay competitive:

- Prices should reflect market conditions and perceived value.

- Properties should be well-maintained, energy-efficient, and located in high-demand areas.

- Landlords must employ strategic rent increases.

Working with a property management company can help you stay on top of the local market, price your rental, and ensure your property remains competitive in Seattle’s rental landscape.

Seattle housing market trends in 2025

Median rent prices in Seattle

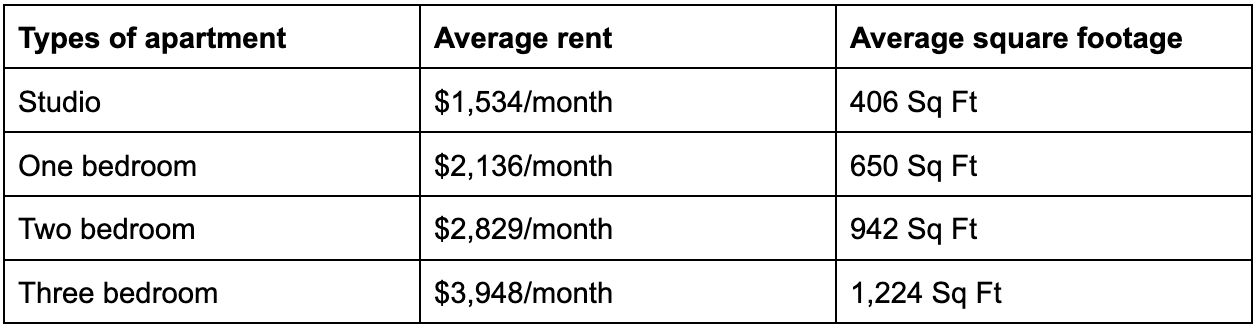

Seattle renters pay some of the highest rent prices in the Pacific Northwest. As of July 2025, average rental rates in Seattle are:

Tip from SJA Property Management:

To price your rental competitively in today’s market:

- Start by comparing units in your specific neighbourhood and building type.

- Factor in updates, amenities, and tenant demand.

- Avoid the common pitfall of overpricing—a slightly below-market rate can reduce vacancy periods and improve long-term ROI.

Not sure where to start? We offer a free rental pricing analysis to help owners optimize pricing and attract the right tenants.

What do renters pay for utilities in Seattle?

Average monthly utility costs in Seattle (2025)

- Electricity – $196/month estimated monthly cost

- Gas/oil – $100–$250/month estimated monthly cost

- Water and sewage – $75/month estimated monthly cost

- Internet – $78/month estimated monthly cost

Should you include utilities in the rent?

Pros of including utilities in rent:

- Simplifies billing for tenants.

- Can make you stand out in a saturated market.

- Allows you to charge a premium for bundled rent.

Cons of including utilities in rent:

- You take on the risk of rising utility bills or excessive usage.

- Can lead to less mindful consumption by tenants.

- Can reduce transparency if tenants are used to knowing how much of their money is spent on rent versus utilities.

Our tip for owners: If you decide to include utilities in rent, consider setting a monthly cap in lease. For example, “Landlord will cover up to $300/month in utilities”. Alternatively, you can only include certain utilities (like water and garbage) while leaving others that fluctuate more (like electricity and internet) to the tenant. These hybrid models offer more flexibility and control.

Daily living costs in Seattle: What renters pay in addition to rent

While housing is the biggest expense for the large majority of Seattle residents, there are many other expenses renters need to cover each month. These costs impact what tenants can afford and expect from their rental.

Transportation

Seattle is a well-connected city, but it isn’t always cheap to get around:

- Public transit can cost ~$99/month for a standard adult ORCA pass that gives you access to buses, light rail, and streetcars.

- Gas and parking costs are high—you can expect to pay at least $250/month just for parking.

- Even insurance premiums in Seattle are higher than the national rate thanks to the dense traffic and theft risk.

Everyday expenses

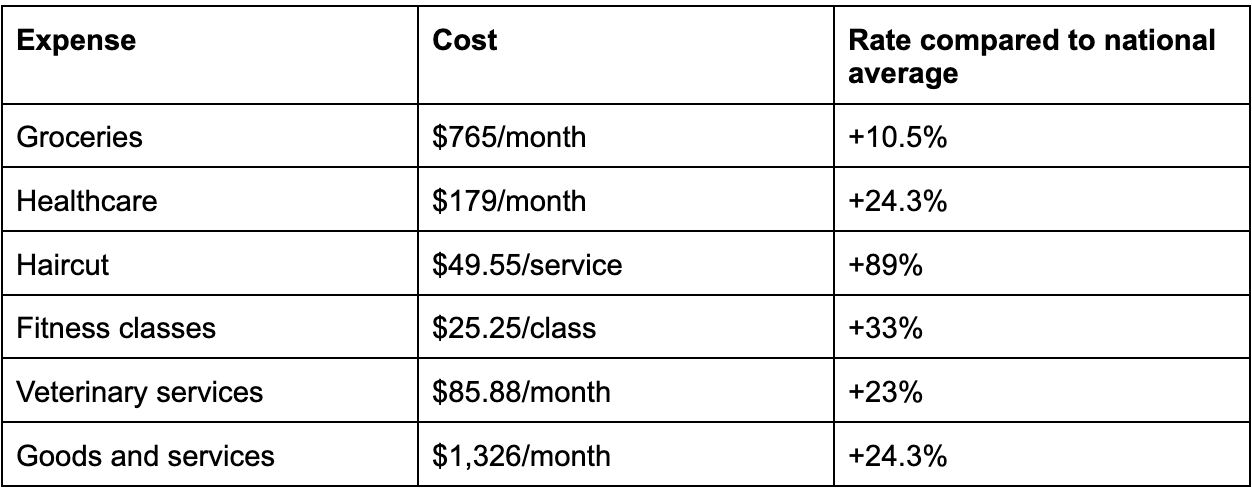

Living in an urban centre like Seattle comes with higher-than-average living costs including:

Seattle’s rent regulations and what they mean for landlords

HB 1217 and 2025’s rent increase limit

In May 2025, Washington state passed House Bill (HB) 1217 in order to increase stability for tenants by introducing limits to rent increases. HB 1217 requires all landlords to cap rent increases to 7% plus the inflation rate or 10%—whichever is lower.

In 2025, the rent cap in Seattle is set at 10%. On January 1, 2026, the rent cap will be 9.693% as set by the state’s Department of Commerce. This rate is based on the latest Seattle-area Consumer Price Index (CPI) of 2.683% (7% + 2.683% = 9.683%).

Additionally, landlords are required to give tenants at least 180 days’ notice before raising rent. While Washington only requires 60 days’, Seattle landlords are bound by the city regulations.

Stay compliant and protected with local expertise

As we’ve seen with the recent changes, Seattle’s tenant regulations change quickly. A small misstep can result in costly fines, tenant complaints, and damage to your professional reputation.

Working with a Seattle-based property manager means you’ll stay compliant—and strategic. From handling notices to navigating new regulations and setting rent increases, a knowledgeable partner can help you manage your risk and maintain your bottom line.

Is Seattle still a good place to own rental property?

What’s driving long-term demand?

The nature of Seattle as a large urban center continues to support the strong need for rental properties:

- The booming tech sector is a major economic driver, bringing in skilled workers from across the country.

- Employers like Amazon, Microsoft, and Google anchor the region’s job market.

- Seattle is a prime destination for students, international professionals, and remote workers, groups who rely on rental housing.

- The area’s limited housing supply and geographic constraints help keep property values high.

Making the right decisions in a high-cost market

The high cost of living along with rising interest rates and new regulations mean landlords need to be more strategic than ever before. Successful rental property owners are:

- Upgrading units to meet tenant expectations and justify higher rents.

- Factoring in cost-of-living pressures when planning rent increases to avoid potential tenant turnover.

- Working with local property managers to stay compliant and responsive to changes in the market.

Why landlords should care about cost of living data

From pricing and tenant expectations to vacancy risk and upgrade decisions, Seattle’s high cost of living plays a role in every aspect of rental ownership.

When you understand the city’s rental trends, living costs, evolving regulations, you can set competitive rents, invest in ROI-boosting upgrades, and retain high-quality tenants.

Seattle may not be the easiest rental market to manage, but it is resilient and full of opportunities. For landlords willing to put in the effort, it can be a worthwhile investment.

Looking to maximize your rental income in the Seattle area? SJA Property Management can help you price and manage your property to stay ahead of the competition. Contact us today to book your free consultation.