Every landlord knows turnover is costly, but in 2026 it is more expensive than most people realize. Rising labor costs, new rental laws in Washington, longer leasing cycles and higher expectations from renters mean that each move-out can put a serious dent in your rental income.

If you are not tracking your turnover expenses in detail, you might be missing one of the biggest threats to your portfolio’s cash flow.

The Real Cost Behind Each Move-Out

1. Lost rent during vacancy

2. Repair and make-ready costs

Standard work like painting, re-caulking and deep cleaning can easily cost $800 to $1,500, depending on unit size and labor rates. And if the flooring, appliances or fixtures are worn out, those expenses jump significantly

3. Marketing and leasing fees

Even if you do your own showings, you still need to pay for ads, listing fees or photography. If you rely on a property manager or leasing agent, that may include a half-month or full-month leasing fee.

4. Law and compliance timing

5. Wear and tear replacements

Even with responsible tenants, items like blinds, carpets and appliances lose life over time. A single carpet replacement can cost $1,200 or more.

Let’s Look at a Real Scenario

Imagine you own a unit in Kirkland and a tenant moves out in March 2026.

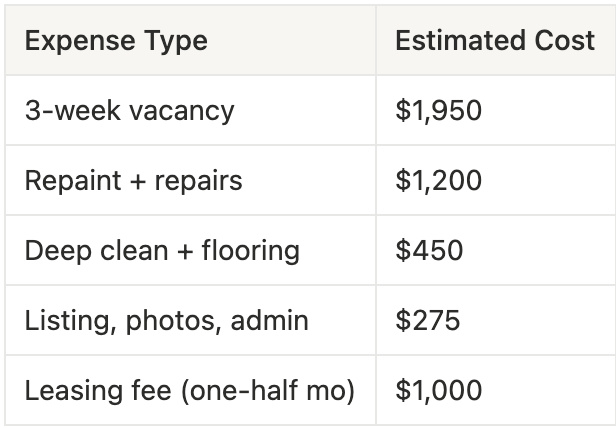

Here is an average cost breakdown:

Your total cost is potentially $4,875 to get that unit rented again. Multiply that by two or three units in a year, and turnover could cost over $10,000.

How Landlords Can Avoid High Turnover Costs in 2026

1. Build strong relationships

2. Offer renewal rewards

3. Stay ahead on maintenance

4. Use strategic rent increases

Tenant turnover is not just a routine part of the rental business anymore. In 2026, every move-out represents thousands in hidden costs unless you plan ahead. The landlords who succeed are the ones who intentionally retain good tenants, forecast costs and adjust their strategies to fit new rental rules and new tenant expectations.

Interested in lowering your turnover rate or getting help building a tenant retention plan? Reach out to SJA Property Management for a customized rental strategy built around your property’s goals.