How active are institutional investors in Seattle's housing market?

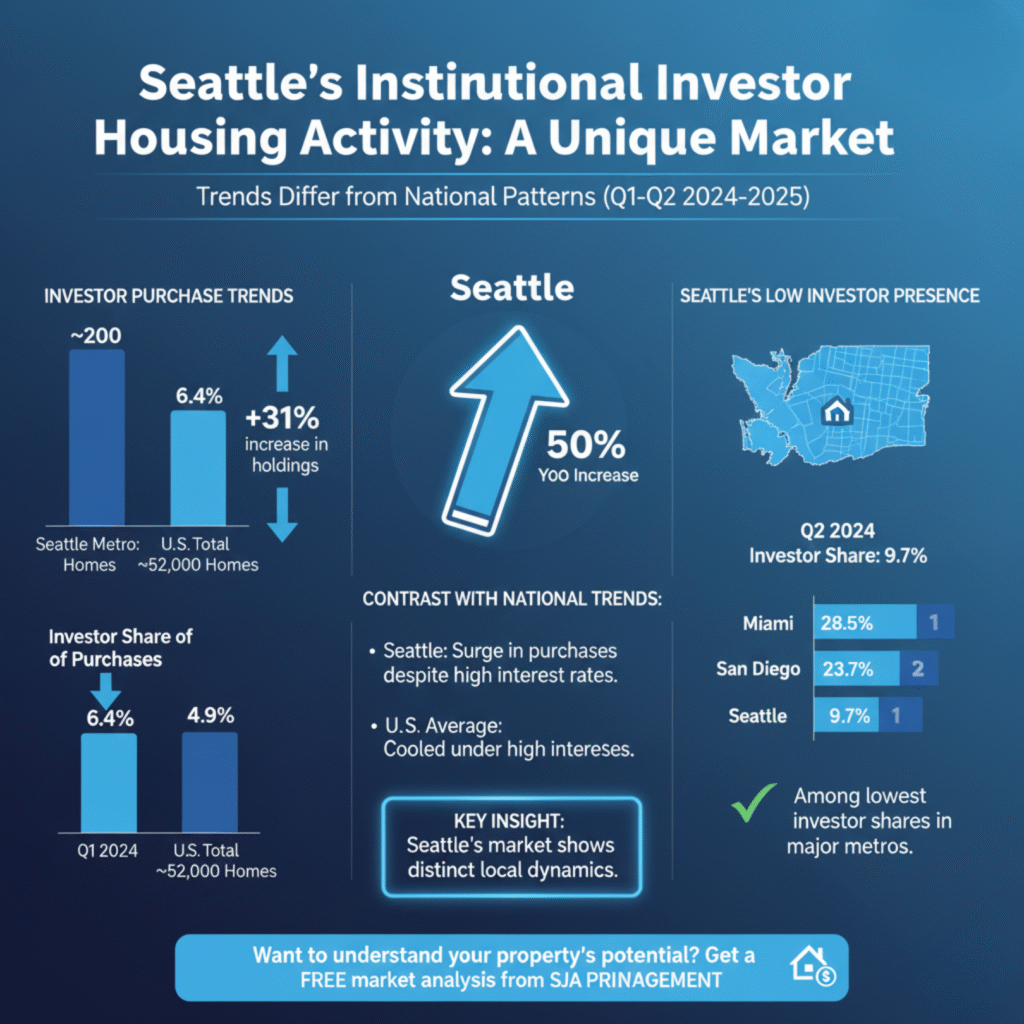

Institutional investors Seattle real estate activity has shown unique patterns that differ significantly from national trends. Between April and June 2024, investors with portfolios of more than 100 homes (known as mega and large institutional investors) purchased roughly 200 single-family residential homes in the Seattle metro area, boosting their holdings from 770 to 1,010 homes. This represents a 31% increase.

Redfin reported investor purchases of Seattle homes rose 50% year over year during the same period. However, more recent data from ATTOM shows the share of homes sold to institutional investors (defined as non-lending entities buying at least 10 properties per calendar year) dropped from 6.4% in the first quarter of 2024 to 4.9% in the first quarter of 2025, suggesting a cooling trend.

Seattle investor activity contrasts with national patterns. Across the U.S., investors bought about 52,000 homes in the second quarter of 2024, down 6% from the previous year. Seattle’s surge occurred while the broader U.S. housing market cooled under high interest rates.

Importantly, Seattle shows one of the lowest shares of investor purchases among major metros. Redfin data indicates Seattle had 9.7% investor purchase share in Q2 2024, with year over year decreases of 1 percentage point. This places Seattle among metros with the smallest investor presence, compared to Miami at 28.5% or San Diego at 23.7%.

Want to understand how institutional investor activity affects your property investment strategy? Get a free market analysis from SJA Property Management to evaluate competitive dynamics and opportunities in your target neighborhoods.

What percentage of Seattle homes do institutional investors actually own?

While headlines sometimes suggest massive institutional ownership, actual data shows more modest figures. Large institutional investors (those owning over 100 homes) own about 3% of single-family rental stock nationwide according to Brookings Institute research. In the 20 Metropolitan Statistical Areas where these investors are most present, they own 12.4% of rental stock. Research by John Burns Research and Consulting found institutional investors are buying less than 2% of all homes nationally.

In Seattle specifically, about 9% of home sales went to investors in 2023 according to testimony submitted to the Washington state Senate. When smaller investors are included in Seattle’s total investor purchases, the increase during mid-2024 was 16%, indicating that mom-and-pop investors still represent the majority of investor activity.

Nationally, rental home investors own about 9.9% of all homes in America, with small investors (those owning less than 5 properties) representing 85% of all investor-owned residential properties. Large rental investor groups have actually been selling more homes than they’re buying for six consecutive quarters as of 2025, with major landlords like Invitation Homes, Progress Residential, American Homes 4 Rent, and FirstKey Homes all selling more than purchasing.

The data suggests institutional investor presence in Seattle remains relatively limited compared to both national averages and other major metropolitan areas.

Why did Seattle see an institutional investor surge when national activity declined?

Several Seattle-specific factors explain the divergent trend. Steven Bourassa, director of the Washington Center for Real Estate Research, noted that rather than taking owner-occupied units off the market, investors may be acquiring properties for redevelopment, potentially giving buyers more opportunities.

Washington state lawmakers’ push to allow denser housing, including the Legislature’s passage of House Bill 1110 (the middle housing bill), likely contributed to investor interest. This legislation requires many cities to allow more housing types on lots once restricted to single-family homes, creating redevelopment opportunities.

Daryl Fairweather, Redfin chief economist, explained that Seattle has liberalized its zoning, making it easier to build more housing on a single-family lot. This benefits investors willing to build a duplex or add an ADU on the lot. Seattle also has a large population of high-income earners who may be looking to become mom-and-pop landlords and build wealth through real estate.

Selma Hepp, Cotality economist, noted that a one-off purchase of an entire subdivision could also have contributed to Seattle’s spike in single-family housing being bought by large investors, suggesting some of the surge may reflect unique transactions rather than sustained trends.

Need strategic guidance on navigating a market with changing investor activity? Schedule a free consultation with SJA Property Management to develop investment strategies that account for institutional competition and zoning changes.

How does institutional investor activity affect local homebuyers?

The impact depends significantly on investor behavior and market context. In Seattle’s case, where institutional investors appear focused on redevelopment opportunities rather than simply converting existing owner-occupied homes to rentals, the effect may differ from markets where investors compete directly for move-in ready starter homes.

Research reviewed in a GAO report examining 74 studies found that institutional investors may have contributed to increasing home prices and rents following the 2007-2009 financial crisis. However, information on these investors’ effects on homeownership opportunities and tenants remains unclear because data are limited and there is no consistent definition of institutional investor across studies.

The recent decline in institutional investor purchases in Seattle (from 6.4% to 4.9% between Q1 2024 and Q1 2025) could mean less competition for first-time homebuyers trying to enter the market. Nationally, institutional investors are now selling more homes than they buy, potentially increasing inventory available to individual buyers.

Seattle’s relatively low investor share (9.7% with year over year decrease) compared to metros like Miami (28.5%) or San Diego (23.7%) suggests local buyers face less institutional competition than buyers in many other major markets.

Concerned about competing with investors for properties? SJA Property Management offers 8 client guarantees including our 24-hour Response Time commitment and comprehensive market analysis that helps you identify opportunities with less institutional competition.

What role do small "mom-and-pop" investors play compared to large institutions?

Small investors dramatically outnumber large institutions and own the vast majority of rental properties. Nationally, small investors own 85% of all investor-owned residential properties. Before the 2007-2009 financial crisis, investors owned about 10 million single-family rental units in the U.S., consisting mostly of smaller investors who owned 10 or fewer units.

In Seattle, Daryl Fairweather noted the city’s large population of high-income earners looking to become mom-and-pop landlords and build wealth through real estate. When smaller investors are included in Seattle’s Q2 2024 figures, purchases rose 16% during that period, indicating robust small investor activity alongside institutional purchases.

Craig Pellegrini, a Redfin Premier real estate agent in San Jose, observed similar patterns in West Coast markets. About one-quarter of buyers he speaks to are investors, with roughly half being institutional investors and the other half mom-and-pop investors. He noted parents buying second homes to rent out and eventually pass to their kids, plus tech professionals taking on real estate investing as a side hustle.

The distinction matters because small investors typically operate differently than institutions. They may be more flexible on pricing, have different holding periods, and often maintain properties themselves rather than through corporate management structures.

What opportunities does institutional investor activity create for individual investors?

Institutional investor behavior can create strategic opportunities for smaller investors willing to pursue different strategies. As large institutions focus on specific property types and locations, they often leave gaps that individual investors can exploit.

In Seattle specifically, institutional focus on redevelopment opportunities under liberalized zoning creates potential for small investors to pursue similar strategies on a smaller scale. Adding ADUs or converting single-family homes to duplexes where zoning allows can generate returns while increasing housing supply.

The fact that major institutional landlords are selling more homes than they’re buying (six consecutive quarters as of 2025) means more inventory potentially becoming available. These properties often come to market as turnkey rentals with established rental history, providing opportunities for individual investors to acquire performing assets.

Seattle’s relatively low institutional investor presence (9.7% purchase share) compared to other major metros means individual investors face less competition from deep-pocketed institutions. Markets with lower institutional penetration often provide better opportunities for investors using conventional financing rather than all-cash purchases.

The shift toward build-to-rent communities by large institutions means they’re focusing on new construction rather than acquiring existing homes, potentially reducing direct competition for resale properties.

Ready to identify opportunities in Seattle’s evolving investor landscape? Contact SJA Property Management for strategic investment analysis that helps position your portfolio for success alongside institutional activity.

How is Seattle's multifamily market responding to investor interest?

Seattle’s multifamily market showed resilience in 2024 with distinct investor dynamics. The market closed 2024 with 101 multifamily transactions totaling $1.6 billion, representing clear improvement from 2023 (sales up 23% year over year, volume up 82% year over year), though still below historical averages.

Average occupancy in Seattle reached 94.4% in Q4 2024, ranking among the highest of major markets nationwide and representing a 10 basis point annual improvement. Effective rents rose to $2,019 in Q4 2024, reflecting 1.7% year over year increase and remaining above national benchmarks.

New unit completions are projected to decline by 50% in 2025, with just 3,397 apartment units breaking ground in 2024 across the metro. This 50% drop in apartment starts suggests developer caution despite strong fundamentals. The reduction should help ease competition among lease-up properties, many of which relied on elevated concessions to attract renters.

Healthy rent growth is forecast for 2025, with annual increases reaching 2.7% by year end and average monthly rent expected at $2,073. Submarkets with limited new deliveries like Federal Way and Issaquah are poised for robust annual rent growth exceeding 3.5%, driven by constrained supply and steady apartment demand.

Leasing activity has remained strong, easing rises in vacancy rates after a historic construction surge. With pricing now adjusted to higher interest rates, more robust recovery in investment activity is expected in 2025.

Should local buyers view institutional investors as competitors or market stabilizers?

The evidence suggests a nuanced answer depending on buyer goals and market segments. For owner-occupant homebuyers seeking move-in ready properties in established neighborhoods, institutional investors can represent competition, particularly when they make all-cash offers that close quickly without financing contingencies.

However, research shows institutional investors also contributed to market stabilization following the 2007-2009 financial crisis by purchasing foreclosed properties that might otherwise have sat vacant, helping stabilize neighborhoods. Their current shift toward redevelopment and build-to-rent rather than acquiring existing homes may actually reduce direct competition for traditional homebuyers.

For individual investors, institutional activity can signal market opportunities. If large institutions are actively investing in a market, it suggests confidence in fundamental economics. Individual investors can often compete effectively by focusing on property types, locations, or strategies that don’t interest larger institutions.

Seattle’s specific dynamics including liberalized zoning, low overall investor share compared to other metros, and declining institutional purchase rates suggest a market where individual buyers and small investors can operate successfully without overwhelming institutional competition.

The key is understanding where institutional investors focus their activity. In Seattle’s case, emphasis on redevelopment opportunities and multifamily properties may actually benefit the market by increasing overall housing supply through density, potentially improving affordability over time.

Want expert perspective on positioning yourself strategically relative to institutional investor activity? SJA Property Management provides comprehensive market intelligence and investment strategy consulting that helps you identify and capitalize on opportunities in Seattle’s dynamic real estate market.

Navigating Seattle's Investor Landscape

Institutional investors Seattle real estate activity represents one factor among many shaping the market. While headlines sometimes suggest overwhelming institutional dominance, actual data shows Seattle has one of the lowest institutional investor shares among major metros, with recent trends showing declining activity.

Individual buyers and small investors can succeed by understanding where institutional investors focus and identifying opportunities they overlook. Seattle’s liberalized zoning creates redevelopment potential that both large institutions and individual investors can pursue. The multifamily market shows strong fundamentals with improving occupancy and rent growth supported by declining new construction.

For owner-occupants, Seattle’s relatively low institutional investor presence compared to markets like Miami or San Diego means less competition from all-cash institutional buyers. For individual investors, the market offers opportunities in segments less attractive to large institutions.

Ready to develop a strategy that accounts for institutional investor activity while identifying your best opportunities? Contact SJA Property Management for fact-based market analysis, strategic investment planning, and professional property management that helps you compete effectively in Seattle’s evolving real estate landscape.

Continue expanding your Seattle real estate knowledge with our complete library of market analysis and investment strategy resources.