Setting the right rent for your property is a critical balancing act. Price it too high, and you risk long vacancies; too low, and you leave money on the table. The key is to find that sweet spot where your rental price attracts tenants quickly while maximizing your income. In this guide, we’ll explore the importance of pricing rent correctly, the factors that influence rental pricing, and actionable strategies to help landlords make informed decisions.

Why Pricing Rent Correctly Matters

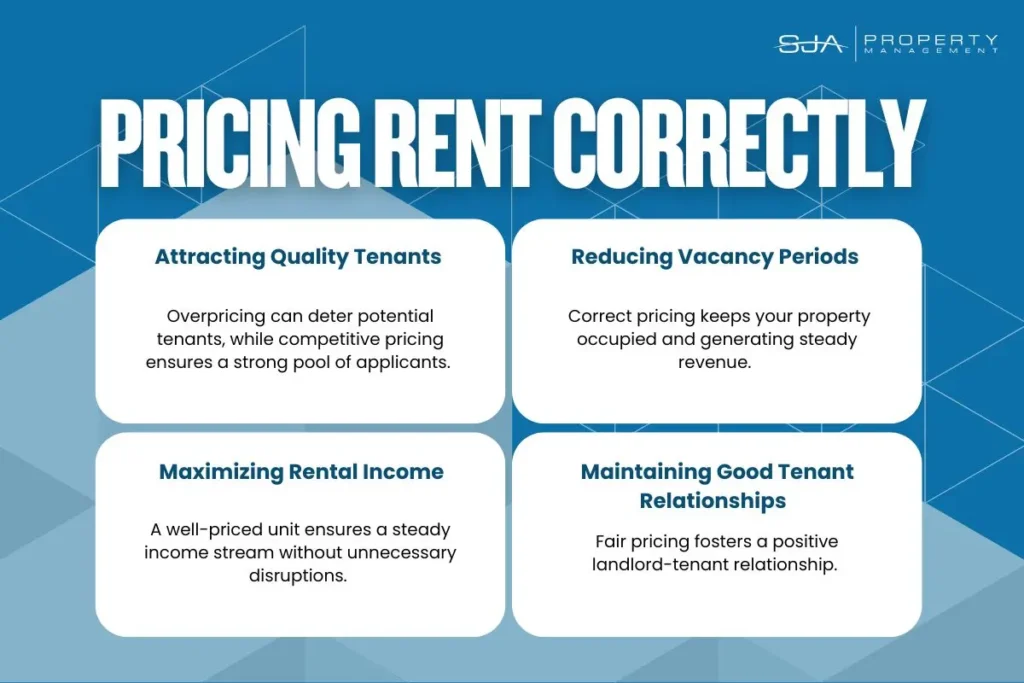

The rental price you set has a direct impact on your property’s profitability, vacancy rate, and tenant retention. Here’s why getting it right is so important:

1. Attracting Quality Tenants

Tenants have access to a vast amount of rental listings, and they will compare prices before making a decision. Overpricing can deter potential tenants, while competitive pricing ensures a strong pool of applicants.

2. Reducing Vacancy Periods

An overpriced rental can sit vacant for weeks or months, costing landlords thousands in lost income. Correct pricing keeps your property occupied and generating steady revenue.

3. Maximizing Rental Income

While setting a higher rent may seem like a good idea, it can backfire if it leads to frequent tenant turnover or long vacancies. A well-priced unit ensures a steady income stream without unnecessary disruptions.

4. Maintaining Good Tenant Relationships

If tenants feel they are paying a fair rent, they are more likely to stay longer, reducing

turnover costs and vacancy losses. Fair pricing fosters a positive landlord-tenant relationship.

Key Factors That Influence Rental Pricing

Understanding the variables that affect rental pricing is crucial for making an informed decision. Consider these factors when determining your rental rate:

1. Market Conditions

The local real estate market plays a huge role in setting rental prices. Research recent rental trends in your area, including:

- Average rental prices for similar properties

- Supply and demand in the local market

- Economic factors that may impact affordability

2. Location

A rental in a high-demand neighborhood will command higher rent compared to a similar unit in a less desirable area. Consider:

- Proximity to public transportation, schools, and shopping centers

- Crime rates and neighborhood desirability

- Local job market and economic growth

3. Property Size and Features

Tenants are willing to pay more for rentals that offer desirable features. Factors that affect pricing include:

- Number of bedrooms and bathrooms

- Square footage and layout

- Modern appliances and renovations

- Extra amenities (e.g., in-unit laundry, parking, outdoor space)

4. Seasonality

Rental demand fluctuates throughout the year. Generally, spring and summer months see higher demand, while winter months experience slower leasing activity. Adjust pricing based on seasonal trends to minimize vacancies.

5. Competitor Analysis

Analyzing comparable listings in your area (known as “comps”) helps you determine a competitive rental price. Look at:

- Properties with similar size, features, and location

- Rental prices and lease terms of comparable units

- How long similar properties stay on the market

6. Operating Costs

Factor in expenses such as property taxes, maintenance, insurance, and management fees when setting rent. Your rental price should cover these costs while still providing a reasonable return on investment (ROI).

How to Determine the Right Rent Price

Now that you understand what influences rental pricing, here’s a step-by-step approach to setting the perfect rent amount:

Step 1: Research the Market

Check local rental listings, property management websites, and platforms like Zillow, Craigslist, and Apartments.com to analyze rental trends in your area. Make sure you are paying attention to how many days the comparable properties have been listed.

Pro tip: If a property has been listed for more than 30 days, that property could be overpriced.

Step 2: Use Online Rent Calculators

Several online tools, such as Rentometer and Zillow’s Rent Zestimate, provide rental estimates based on location and property features. Keep in mind, these online calculators are for reference only. The market dictates what a property will rent for, not computers!

Step 3: Assess Your Property’s Value

Compare your rental unit to similar properties and make necessary adjustments based on unique features or limitations.

Step 4: Factor in Expenses

Ensure that your rental price covers:

- Mortgage (if applicable)

- Property taxes

- Insurance

- Maintenance and repairs

- Property management fees (if using a management company)

Common Mistakes to Avoid When Setting Rent

Even experienced landlords can make pricing mistakes. Here are some common pitfalls and how to avoid them:

1. Overpricing the Rental

Many landlords assume that higher rent equals higher income, but overpricing can lead to prolonged vacancies. If your rental remains vacant for too long, consider lowering the price to align with market rates.

2. Ignoring Market Trends

Failing to adjust rent based on market trends can result in overpriced or underpriced units. Stay updated on economic changes and rental demands in your area.

3. Not Accounting for Expenses

Some landlords set rent based on market rates but forget to factor in property-related costs. Ensure that rent covers all expenses while still offering a fair market price.

4. Neglecting Tenant Retention

While raising rent is necessary to keep up with inflation, frequent increases can push long-term tenants away. Weigh the benefits of a modest rent increase against the potential cost of vacancy and turnover.

5. Failing to Adjust Rent for Lease Renewals

Some landlords forget to increase rent when renewing a lease, leading to lost income over time. Gradual, reasonable increases help keep rent competitive without shocking tenants.

Pricing your rental property correctly requires a balance between maximizing income and keeping your property occupied. By researching the market, considering property features, and understanding tenant expectations, you can set a competitive rent that attracts quality tenants while ensuring a steady cash flow.

If you’re struggling with pricing your rental, consider working with a professional property management company like SJA Property Management. We specialize in market analysis, tenant screening, and lease management to help landlords get the most out of their investment.

DISCLAIMER:

Whether you’re a landlord or a tenant, staying informed is essential for a smooth and successful rental experience in Seattle. We are not providing legal advice, and for specific legal questions or concerns, we recommend consulting an attorney or reaching out to local housing authorities for expert guidance.