Renting out a condo has become one of the most reliable ways for homeowners and investors to generate steady, long-term income, especially in competitive markets like Seattle, Bellevue, Everett, Redmond, Kirkland, and the greater Puget Sound area. With strong rental demand, limited housing inventory, and a growing population of professionals seeking amenity-rich living, condos continue to present an attractive investment opportunity.

At SJA Property Management, we’ve spent more than 16 years helping property owners navigate the complexities of the rental market. Today, we manage over 1,000 homes and more than half a billion dollars in residential real estate across Washington State. We’ve seen firsthand what makes a condo rental successful. That experience gives us deep insight into how to maximize returns while minimizing legal, financial, and operational risk.

This guide is designed for:

- First-time landlords who are exploring the idea of renting out their condo

- Homeowners relocating, upsizing, or downsizing who want to turn their current condo into a source of income

- Real estate investors looking to diversify their portfolio and understand the unique considerations of condo rentals

Whether you own a downtown Seattle high-rise unit, a condo near Microsoft in Redmond, or a suburban property in Snohomish County, this comprehensive guide will walk you through everything you need to know.

You’ll learn:

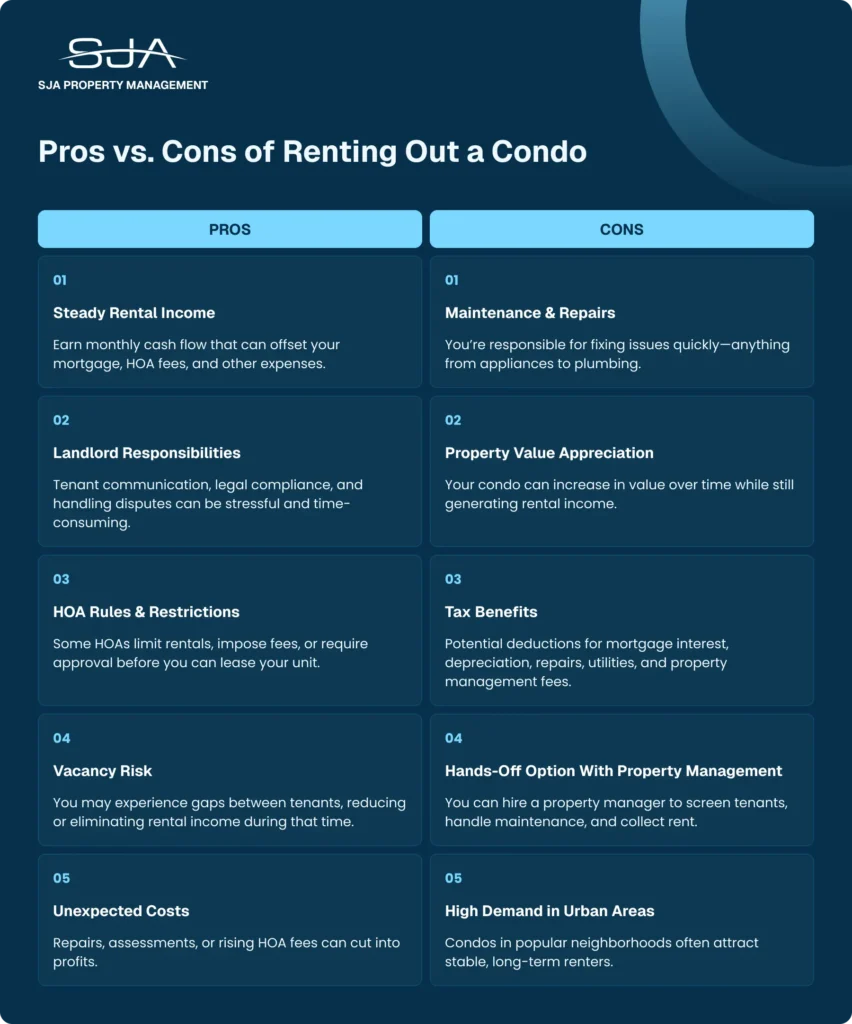

- The pros and cons of renting out a condo (specific to Puget Sound markets)

- The legal and HOA requirements you must understand before listing your unit

- How to prepare, market, and price your condo for maximum profitability

- Ongoing management best practices, including maintenance, inspections, rent increases, and more

Our goal is to help you make an informed, confident decision while avoiding the common mistakes that cost condo owners time, money, and peace of mind.

Is Renting Out a Condo a Good Idea?

In short, yes. Renting out a condo can be an excellent way to generate consistent income, especially in high-demand markets like Seattle, Bellevue, and the greater Puget Sound region. However, success ultimately depends on understanding the building’s HOA rules, analyzing your cash flow, and preparing for the responsibilities that come with being a landlord. When done correctly, a condo can deliver strong returns with less maintenance than many other property types.

Key Benefits

- Lower maintenance responsibilities thanks to HOA-covered exterior and common-area upkeep

- Strong rental demand in urban and tech-driven areas across King and Snohomish counties

- Attractive amenities (such as gyms, security, and shared spaces) that help justify premium rent

- Potential tax advantages, including deductions for HOA fees, repairs, and depreciation

- Simplified long-term management, especially when supported by a professional property manager

Key Drawbacks

- HOA rental restrictions, such as rental caps or lengthy approval processes

- Monthly HOA dues, which can reduce net cash flow if not accounted for upfront

- Limited control over building rules, renovations, pet policies, or guest access

- Risk of special assessments, which may add unexpected expenses

- Possible vacancy or market fluctuations, particularly in slower seasons

When Renting Out a Condo Makes Sense

Renting out your condo is usually a smart move when:

- Your HOA allows rentals without long waitlists or restrictions

- Market rents in your area (such as Seattle, Bellevue, Kirkland, or Everett) support positive cash flow

- You want a hands-off investment, with the HOA managing exterior maintenance

- You plan to hold the property long term to benefit from appreciation

- You prefer an investment that appeals to stable, long-term tenants, such as professionals or downsizers

When It Might Not Be the Best Choice

On the other hand, renting out a condo may not be ideal if:

- Your building has a rental cap, long waitlist, or strict HOA rules

- HOA dues and your mortgage make it difficult to achieve break-even cash flow

- You plan to sell the property soon and want to avoid tenant-occupied sales limitations

- The building is experiencing frequent special assessments or financial instability

- You want complete control over modifications, pets, or policies (which HOAs often limit)

Pros of Renting Out a Condo

Renting out a condo can be an excellent investment strategy, especially in high-demand areas like Seattle, Bellevue, and the broader Puget Sound region. While every property is unique, condos often offer distinct advantages that make them appealing for first-time landlords and seasoned investors alike. Below, we break down the key benefits that can make condo ownership a smart long-term move.

Passive Income Potential

Monthly Cash Flow

To begin with, one of the biggest advantages of renting out a condo is the opportunity to earn consistent monthly income. In urban and tech-driven markets—such as downtown Seattle, South Lake Union, and Bellevue—rental demand remains strong year-round. This allows well-positioned condos to generate steady cash flow that offsets mortgage payments, HOA dues, and other ongoing expenses.

Long-Term Wealth Building Through Appreciation

Moreover, condos in the Puget Sound area have historically appreciated, particularly in neighborhoods near major employers like Amazon, Microsoft, and Boeing. As property values rise, owners build equity over time, creating long-term financial stability while still collecting rental income. This combination of immediate cash flow and long-term appreciation is one of the main reasons condo rentals remain a popular investment vehicle.

Lower Maintenance Responsibilities

HOA/Condo Association Handles Exterior Maintenance

Unlike single-family homes, condos typically require less hands-on upkeep. HOAs often manage exterior maintenance, landscaping, roofing, common-area repairs, and even certain utilities. This reduces the number of tasks a landlord must worry about and helps ensure the building remains well-maintained.

Less Time Commitment Compared to Single-Family Rentals

Consequently, condo owners tend to spend far less time coordinating repairs, hiring contractors, or addressing unexpected issues. This makes condos especially appealing for owners who want a low-maintenance investment or for those who plan to hire a property management company like SJA to handle day-to-day operations.

Amenities Increase Rental Value

Gyms, Pools, Security Can Justify Higher Rent

Another major advantage is the amenity-rich lifestyle condos provide. Features such as fitness centers, rooftop decks, swimming pools, private parking, and controlled-access entry all add value and allow landlords to command higher rent compared to similar-sized apartments without amenities.

Strong Appeal for Urban Professionals & Downsizers

Additionally, amenities create strong tenant demand, particularly among professionals working in Seattle’s tech hubs, as well as retirees or downsizers who prioritize convenience and community. Buildings near transit, waterfronts, or major employment centers tend to attract long-term, reliable renters willing to pay a premium for quality amenities.

Built-In Community & Security

Gated Access, Concierge, Building Staff

Security is often a top priority for renters, and condos typically excel in this area. Many buildings offer secured entrances, gated garages, concierge services, package lockers, and on-site staff—all of which enhance tenant safety and convenience.

Tenant Safety and Property Protection Benefits

Furthermore, these added layers of protection help safeguard your investment. A secure building discourages unauthorized access, reduces risk of theft or property damage, and provides tenants with greater peace of mind. As a result, units in secure buildings tend to enjoy lower turnover and attract higher-quality renters.

Potential Tax Benefits

Depreciation, Repairs, Operating Expenses, HOA Fees

Finally, condo owners may be eligible for a variety of tax benefits that improve the property’s overall return. Many expenses (including repairs, HOA dues, insurance, property management fees, and even depreciation) may be deductible. These tax advantages can significantly reduce the overall cost of ownership and increase net profits.

Opportunity to Work with a Tax Professional

Tax laws can vary, it’s wise to work with a licensed tax professional who understands real estate investments in Washington State. At SJA, we frequently collaborate with property owners and their CPAs to ensure they’re maximizing every eligible deduction while staying compliant.

Cons of Renting Out a Condo

While renting out a condo can be a smart investment strategy, it also comes with a unique set of challenges that owners must understand upfront. Unlike single-family homes, condos are governed by HOA rules that can significantly impact your ability to rent, manage, and profit from your unit. Below are the most important drawbacks to consider before moving forward.

HOA Restrictions & Rules

Limits on Rentals

To start, many condo associations enforce rental caps or waitlists, which restrict how many units within the building can be leased at any given time. If the rental cap is already met, you may need to wait months (or even years) before being allowed to rent your unit.

Add Your Heading Text HereApproval Processes, Lease Rules, Tenant Screening Requirements

Additionally, most HOAs require owners to submit leases for approval, adhere to specific move-in/move-out procedures, and follow strict guidelines regarding tenant behavior. Some associations even require tenants to be screened or approved by the board. These steps can create delays or complications, especially if you’re working against a tight timeline.

Monthly HOA Fees

How HOA Dues Affect Cash Flow

Another major consideration is the cost of HOA dues. While these fees often cover valuable services (like exterior maintenance, security, and amenities) they can significantly impact your monthly cash flow if rental income doesn’t offset them. When running the numbers, it’s essential to factor in HOA dues as a fixed expense.

Risk of Owner-Imposed Special Assessments

Moreover, HOAs can impose special assessments to cover unexpected building repairs or capital improvements. These assessments can be substantial and may arise with little notice, affecting profitability and budgeting. Owners should review the HOA’s financial reserves and meeting minutes to identify any red flags before renting out their unit.

Limited Control

HOA May Restrict Renovations, Pets, Guest Access, Etc.

Condo associations set building-wide rules, owners sometimes face limited control over how their property is managed. HOAs may restrict interior renovations, flooring choices, paint colors, or short-term rentals. They can also enforce rules about pets, smoking, parking, and guest access. For landlords, this means fewer opportunities to customize the unit or adjust policies to attract tenants.

Market & Vacancy Risks

Changing Demand

Like all rental properties, condos are subject to shifts in market demand. Factors such as new apartment construction, economic changes, or fluctuations in tech employment can influence rental rates in areas like Seattle, Bellevue, and Everett.

Off-Season vs. Peak Rental Periods

In addition, vacancy risk can increase during off-season periods, typically the winter months in the Pacific Northwest, when fewer renters are searching. Conversely, spring and summer tend to be peak leasing seasons. Understanding these trends is crucial for setting realistic expectations around occupancy and pricing.

Potential for HOA Conflicts

Compliance Issues

Finally, renting out a condo can sometimes lead to conflicts with the HOA, especially if tenants unintentionally violate building rules. Even minor issues (such as parking violations, noise complaints, or improper use of common areas) can put you at odds with the association.

Fines, Disputes, Neighbor Complaints

If problems arise, HOAs may levy fines, require corrective action, or involve building management. In some cases, repeated issues can strain relationships with neighbors or create ongoing disputes. This is one reason many owners choose to work with a professional property management company like SJA, we help ensure tenants understand and follow all HOA rules, reducing the risk of conflicts.

What to Know Before Renting Out Your Condo

Before you list your condo for rent, it’s essential to prepare properly. Condo rentals are governed not only by Washington State landlord-tenant laws but also by HOA rules that can significantly impact your ability to rent the unit. By understanding these requirements upfront, you can avoid costly delays, ensure compliance, and set your investment up for long-term success.

Check Your Condo Association’s Rental Policies

One of the first and most critical steps is verifying whether your homeowners association (HOA) allows rentals and under what conditions. HOA rules vary widely across Seattle, Bellevue, Everett, and the greater Puget Sound region, so a thorough review is essential.

Common HOA Rental Restrictions

Rental Caps

Many condo associations enforce rental caps, limiting how many units in the building can be leased at once. If the cap is already reached, you may be placed on a waitlist, which can delay your plans significantly.

Minimum Lease Terms

Additionally, HOAs often require a minimum lease term, typically 6 or 12 months, to prevent short-term rentals or frequent turnover. This can impact your strategy if you were considering furnished or shorter-term leasing.

Application Fees

Some associations charge administrative or application fees for processing rental documentation or tenant move-ins. These fees may apply to either the owner or the tenant.

Move-In/Move-Out Procedures

Finally, most HOAs require tenants to schedule move-ins, reserve elevators, or follow specific procedures designed to protect common areas. Failure to comply can result in fines, so it’s crucial to communicate these rules clearly to your tenants.

How to Get Approval

Required Forms

Most HOAs require specific forms, such as rental applications, lease addendums, or owner affidavits. These documents typically outline tenant responsibilities and acknowledge compliance with association rules.

Board Review

Once submitted, your request may go through a board approval process. Depending on the association, approval can take anywhere from a few days to several weeks.

Written Authorization

For your protection, always obtain written confirmation that your rental is approved. This documentation ensures you remain compliant and protects you from potential disputes with the HOA.

Understand Local Landlord-Tenant Laws

Next, it’s vital to familiarize yourself with Washington State and local laws that govern rental properties. These regulations outline your responsibilities as a landlord and help protect both you and your tenants.

Fair Housing Rules

You must follow federal, state, and local fair housing laws, which prohibit discrimination based on protected classes. Cities like Seattle and Bellevue also have additional tenant protections.

Security Deposits

Washington has strict rules about how deposits must be handled, documented, and returned. You must provide a written move-in condition report for any deposit you collect.

Notice Requirements

Specific notice periods apply for rent increases, entry into the unit, or ending a lease. These requirements vary depending on jurisdiction, so owners must stay informed.

Eviction Processes

If an eviction becomes necessary, Washington’s eviction laws are detailed and time-sensitive. Working with a professional property manager or housing attorney can help ensure compliance and avoid costly mistakes.

Run the Financial Numbers

Before renting your condo, you’ll want to analyze the financials carefully. This ensures the rental is sustainable and aligns with your long-term goals.

Estimating Rent

How to Research Comparable Listings

Start by reviewing comparable condo rentals in your building or neighborhood. Platforms like Zillow, Apartments.com, and local MLS listings offer useful benchmarks. You can also reach out to us for a free expert rental analysis.

Pricing Based on Location, Amenities, Unit Condition

Consider factors such as:

- Proximity to employers (e.g., Amazon, Microsoft, Boeing)

- Building amenities

- Unit size, layout, and upgrades

- Market rent trends in Seattle, Bellevue, Redmond, Everett, or Kirkland

Setting the right rental price is essential for reducing vacancy time and attracting qualified tenants.

Calculating Expenses

To understand your true cash flow, calculate every recurring and potential cost associated with the condo:

- Mortgage (including principal and interest)

- Insurance (landlord or rental property policies)

- HOA dues

- Property taxes

- Rental license fees (required in some cities)

- Maintenance and repairs

- Property management fees (if applicable)

- Vacancy rate buffer for months without rent

This comprehensive view gives you a realistic picture of the property’s financial performance.

Cash Flow & ROI Analysis

Finally, evaluate whether the condo will deliver strong returns.

Cap Rate

Measures the property’s net operating income relative to its market value. Useful for comparing investment options.

Cash-on-Cash Return

Shows the annual return on the actual cash you’ve invested, including down payments and closing costs.

Break-Even Point

Determines whether the rent collected will cover all expenses, including HOA dues and maintenance.

Running these calculations ensures that renting out your condo is not only feasible but financially rewarding. At SJA Property Management, we often help owners conduct these analyses to determine whether renting or selling is the better long-term strategy.

Additional Considerations

Even after you’ve evaluated the core pros, cons, and requirements of renting out your condo, there are a few additional factors that can significantly impact your long-term success as a landlord. Understanding tax implications, insurance needs, rental strategies, and market conditions will help you make the most informed, and profitable, decision possible.

Tax Requirements & Reporting

Taxes play a major role in the financial performance of any rental property. To maximize your return and remain compliant, it’s essential to understand how the IRS treats rental income and expenses.

Schedule E Basics

Rental income and expenses are reported annually on Schedule E (Form 1040). This form outlines all revenue generated from the property and deducts eligible expenses to calculate your taxable income.

Deductible Expenses

Fortunately, many of the costs associated with renting out a condo are deductible, including:

- HOA dues

- Mortgage interest

- Property taxes

- Repairs and maintenance

- Property management fees

- Utilities you pay on behalf of the tenant

- Advertising and leasing costs

- Insurance premiums

Tracking these expenses throughout the year makes tax filing far easier and ensures you capture all available deductions.

For more information on landlord tax write-offs and strategies, check out our article on rental property tax deductions.

Depreciation Rules

Additionally, condo owners can take advantage of depreciation, a powerful tax benefit that allows you to deduct the property’s value (excluding land) over 27.5 years. Depreciation often results in significant tax savings, even if the property is generating positive cash flow.

When to Hire a CPA

Tax laws change and every owner’s financial situation is unique, you may benefit from working with a CPA who specializes in real estate. At SJA Property Management, we frequently collaborate with owners and their accountants to ensure they understand how deductions, depreciation, and passive income rules apply to their condo.

Insurance Considerations

Proper insurance coverage protects both your property and your financial investment. Condo owners must understand how their individual policy works alongside the HOA’s master insurance policy.

Landlord Insurance

Once your condo becomes a rental, your standard homeowners insurance is no longer sufficient. Instead, you’ll need a landlord or rental dwelling policy, which typically covers:

- Property damage

- Liability

- Loss of rental income due to covered events

This ensures you’re fully protected if a tenant accidentally damages the unit or a covered incident makes the condo temporarily uninhabitable.

For more information on landlord insurance, check out our full article on landlord insurance strategies.

Renter’s Insurance Requirements

It’s also a best practice (and often required by property managers) to mandate renter’s insurance for tenants. This protects their personal belongings and provides liability coverage, reducing the likelihood of disputes or uncovered losses.

HOA Master Policy Considerations

Finally, review your HOA’s master insurance policy. Some associations cover only the building shell (“bare walls”), while others insure certain interior components. Knowing what the master policy includes helps you avoid gaps in coverage and ensures your landlord policy is correctly structured.

Short-Term vs. Long-Term Renting

Before choosing a rental strategy, it’s important to understand the legal and financial implications of both short-term and long-term renting, especially in condo buildings across Seattle, Bellevue, and surrounding areas.

Airbnb/VRBO Restrictions in Condo Buildings

Most HOAs in the Puget Sound region restrict or prohibit short-term rentals (less than 30 days). These restrictions are designed to maintain security, reduce wear on common areas, and preserve the residential nature of the community.

HOA Rules

Even if a building allows short-term rentals, owners are usually required to:

- Register guests

- Follow strict booking procedures

- Adhere to occupancy limits

- Pay additional move-in or cleaning fees

Violating HOA rules can lead to fines or loss of rental privileges.

Licensing and Local Laws

Cities like Seattle require short-term rental operators to obtain specific licenses, meet safety standards, and follow local regulations. Failing to comply can result in penalties or legal issues.

Profitability Comparison

While short-term rentals can potentially generate higher gross revenue, they also involve:

- Higher turnover

- Increased cleaning costs

- More wear and tear

- Seasonality and fluctuating demand

- Greater management time

For most condo owners, a long-term rental strategy is more stable, compliant, and manageable.

When It Might Be Better to Sell Instead of Rent

Although renting out a condo often makes financial sense, there are situations where selling may be the smarter choice.

Market Timing

If the real estate market is strong and your condo has appreciated significantly, selling may provide a higher immediate return than renting. In fast-appreciating areas like Seattle and Bellevue, timing the sale can make a considerable difference.

Negative Cash Flow

If HOA dues, mortgage payments, insurance, and taxes exceed what you can realistically charge for rent, the property may operate at a loss. While some owners are comfortable with this for tax or long-term investment reasons, others may prefer to sell and reposition their capital.

HOA Instability or Rising Dues

Buildings with poor financial reserves, frequent special assessments, or rising HOA dues can erode profitability. If you identify warning signs, such as deferred maintenance or ongoing disputes, selling may reduce your exposure to risk.

Equity Position

If you have significant equity, you may choose to sell and use the proceeds for other investments, personal needs, or opportunities with higher returns. On the other hand, if equity is low, renting the unit until values rise may be the better strategy.

Conclusion

Renting out a condo can be an excellent way to generate passive income, build long-term wealth, and take advantage of the strong rental demand across Seattle, Bellevue, Everett, Redmond, and the greater Puget Sound region. However, as you’ve seen throughout this guide, condo rentals also come with unique considerations, from HOA rules and legal requirements to financial planning and ongoing management responsibilities.

By understanding the pros and cons, reviewing your HOA’s policies, analyzing your cash flow, and preparing your unit properly, you can position your condo for long-term success. And whether you’re a first-time landlord or an experienced investor, having the right support makes the entire process far more seamless and profitable.

At SJA Property Management, we’ve spent more than 16 years helping condo owners navigate the complexities of Washington’s rental market. Our team manages over 1,000 properties and more than half a billion dollars in real estate, giving us the insight and systems needed to protect your investment and maximize your return.

If you’re ready to take the next step, or simply want expert guidance tailored to your specific building or market, we’re here to help.

Our team will:

- Review your condo and provide a custom rental analysis

- Evaluate HOA rules and potential compliance issues

- Offer clear recommendations on pricing, tenant screening, and leasing strategy

- Explain how we can manage the property for you from start to finish

Click here to schedule a consultation and begin the process with confidence.

With the right strategy and the right partner, you can turn your condo into a high-performing, low-stress investment. Let SJA Property Management help you get there.

Frequently Asked Questions

Can you rent out a condo you just bought?

In many cases, yes, but it depends entirely on your condo association’s rental policies. Some HOAs allow immediate rentals, while others enforce rental caps, waiting periods, or owner-occupancy requirements. Before purchasing or leasing your unit, review the HOA’s governing documents or consult with your property manager to confirm eligibility.

Do all HOAs allow rentals?

No. Not all HOAs allow rentals, and those that do often impose specific restrictions. Common limitations include rental caps, minimum lease terms, tenant registration requirements, and move-in procedures. Always check your building’s bylaws, CC&Rs, and board policies to understand what’s permitted.

Is condo rental income taxable?

Yes. All rental income must be reported on your tax return, typically using Schedule E (Form 1040). The good news is that you can deduct many rental-related expenses, such as HOA dues, repairs, insurance, depreciation, and management fees, which may significantly reduce your taxable income.

Do I need permission to rent out my condo?

In most buildings, yes. HOAs often require landlords to submit rental forms, provide a copy of the lease, and obtain written approval before a tenant moves in. Some associations also require board review or tenant background checks. Getting proper authorization ensures compliance and helps avoid fines or violations.

What insurance do I need to rent out my condo?

At minimum, you’ll need a landlord insurance policy (also known as a dwelling or rental dwelling policy). This covers property damage, liability, and loss of rental income due to covered events. Additionally, most professional managers, including SJA, recommend requiring tenants to carry renter’s insurance. Finally, review your HOA’s master policy to understand what parts of the building are already covered and ensure your individual policy fills any gaps.