What is the current status of Seattle's light rail expansion?

Seattle’s Link light rail has undergone major expansion. The Northgate extension opened October 2, 2021, adding U District, Roosevelt, and Northgate stations. The Lynnwood extension opened August 30, 2024, adding four stations in Shoreline, Mountlake Terrace, and Lynnwood.

On the Eastside, the 2 Line began service April 27, 2024, operating between South Bellevue and Redmond Technology with stops in East Main, Downtown Bellevue, Wilburton, and Spring District. Downtown Redmond opened May 10, 2025. The full connection across Lake Washington to Seattle is expected early 2026.

Want to identify investment opportunities along transit corridors? Get a free market analysis from SJA Property Management to evaluate emerging neighborhoods based on verified expansion timelines.

What does research show about light rail's impact on property values?

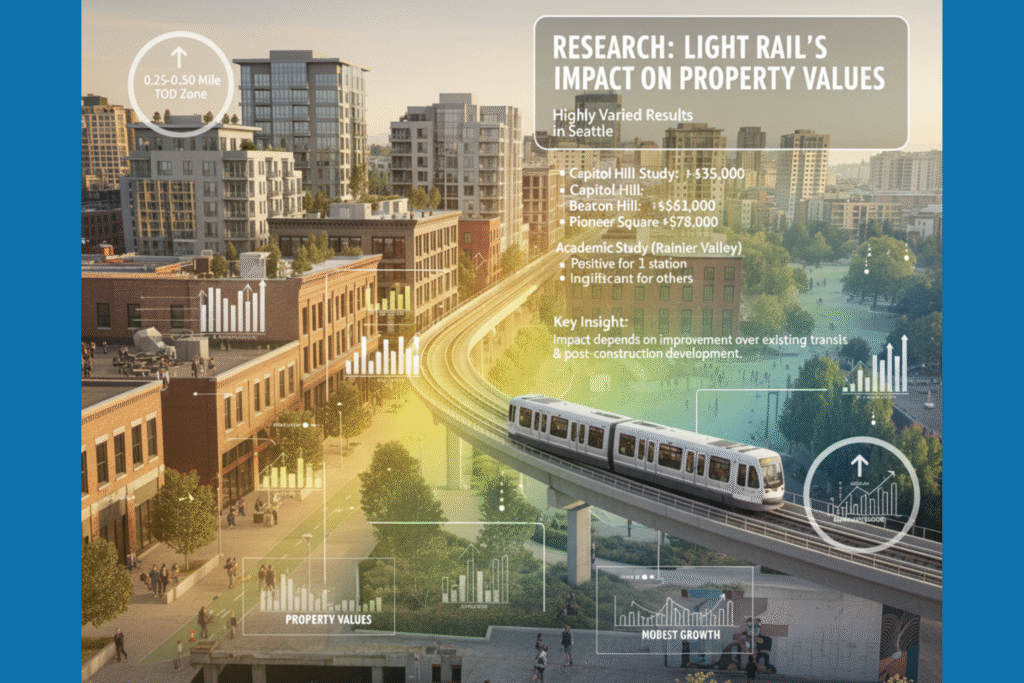

esearch on Seattle light rail expansion real estate reveals highly varied results. A 2016 Estately study found homes near Capitol Hill station sold for approximately $35,000 more than the rest of the neighborhood. Beacon Hill showed a $61,000 premium, and Pioneer Square a $78,000 premium.

However, academic research examining seven Rainier Valley stations found positive impacts for only one station, negative impacts for two stations, and insignificant effects for others. The study concluded light rail didn’t provide measurable value to Rainier Valley neighborhoods because it wasn’t a significant improvement over existing bus lines.

A University of Washington study found transit-oriented development has significant positive impact only after construction, specifically for properties within 0.25-0.50 mile from stations.

The key insight: light rail impact depends heavily on existing transit options and whether new service represents genuine transportation improvement.

Which neighborhoods have shown measurable growth from light rail?

Capitol Hill, Beacon Hill, and Pioneer Square demonstrated documented premiums ranging from $35,000 to $78,000 according to 2016 analysis. These neighborhoods already had strong urban characteristics that light rail enhanced.

Northgate, which opened October 2, 2021, has catalyzed significant mixed-use development. Properties near the planned station showed an $18,000 premium even before opening. Roosevelt and U-District stations serve dense urban neighborhoods where transit complements existing walkability.

Not all neighborhoods see increases, the effect depends on whether transit represents genuine improvement over existing transportation options.

Need expert guidance on evaluating transit-adjacent properties? Schedule a free consultation with SJA Property Management to analyze location-specific factors determining actual value impacts.

How is the Eastside light rail affecting Bellevue property values?

The 2 Line began service April 27, 2024, on the Eastside with stops in East Main, Downtown Bellevue, Wilburton, Spring District, and BelRed. In April 2025, Bellevue’s average home value increased 11.7% year-over-year with median values around $1.6 million, though attributing this solely to light rail is difficult given Bellevue’s broader tech hub growth.

The Spring District transformed from industrial to transit-oriented development with high-tech offices, retail, and urban housing. BelRed evolved from warehouses to modern apartments and creative office space with appreciation outpacing Eastside averages. Wilburton is gaining attention with its new station and planned green space improvements.

National data from APTA suggests homes within 10-minute walks of stations sell for 8-12% more than comparable homes farther out, though this reflects national averages rather than Bellevue-specific measurements.

Ready to evaluate Eastside opportunities? SJA Property Management offers 8 client guarantees including our 30-Day Lease guarantee and professional market analysis focused on transit-oriented neighborhoods.

What future expansions should investors monitor?

West Seattle Link Extension will add 4.1 miles from SODO to Alaska Junction with four stations, scheduled for 2032. The FTA issued Record of Decision on April 29, 2025, moving the project to final design.

Ballard Link Extension will add 7.7 miles from downtown Seattle to Ballard with nine stations, scheduled for 2039. It includes a new downtown tunnel and is in environmental review.

An infill station at NE 130th Street opens in 2026, with Boeing Access Road and Graham Street stations planned for 2031.

These long-term projects create multiple investment windows. Some investors position 3-5 years before opening, others wait for completion to reduce uncertainty about opening dates, which have historically experienced delays.

How far from stations do properties show value impacts?

The 2016 Estately study examined homes “within a mile” of stations. University of Washington research found significant positive impacts for properties within 0.25-0.50 mile from stations in the post-construction period.

Walking quality matters significantly, properties with challenging routes due to hills or highway barriers capture less benefit even within nominal distances. Properties with flat, well-lit routes with good sidewalks can command benefits slightly beyond typical distances.

In Tukwila, homes near the station sold for $88,000 more than the rest of town, showing transit premiums can be substantial even in affordable areas. The key isn’t just distance but actual walkability. Can residents comfortably walk to the station for daily commutes?

Do all light rail stations increase nearby property values?

No. Research examining seven Rainier Valley stations found positive impacts for only one station, negative for two, and insignificant impacts for the rest. Light rail doesn’t automatically create value increases.

In areas already well-served by bus transit, light rail may not represent enough improvement to justify premiums. Station location characteristics matter significantly. Stations in dense, walkable neighborhoods show stronger impacts than stations in auto-oriented areas.

Success requires more than transit access. It needs walkable infrastructure, nearby amenities, and genuine transportation improvements over existing options.

Concerned about realistic expectations? SJA Property Management provides fact-based analysis evaluating actual transportation improvements and neighborhood characteristics affecting values.

How should investors evaluate transit-adjacent properties?

Consider whether light rail represents genuine improvement over existing bus service. Research shows areas with strong transit may see limited benefit from light rail. Evaluate actual walkability. Flat routes with good sidewalks create value, while challenging walks reduce accessibility.

Assess neighborhood development. Are uses becoming mixed and walkable, or does the area remain auto-oriented? Transit alone doesn’t guarantee appreciation without complementary urban development.

Remember Sound Transit projects historically experience delays. East Link, originally projected for 2023, opened the first phase in 2024 with the Seattle connection delayed to early 2026. Properties purchased based on anticipated timelines may face extended holding periods.

Research specific station context. Downtown urban stations show stronger impacts than suburban stations. Capitol Hill, Beacon Hill, and Pioneer Square showed documented premiums while several Rainier Valley stations showed minimal or negative impacts.

Ready for evidence-based strategy? Contact SJA Property Management for comprehensive analysis evaluating actual improvements, neighborhood characteristics, and realistic timelines based on documented data rather than speculation.

Evidence-Based Transit Investment

Seattle light rail expansion real estate opportunities require analysis of documented facts rather than assumptions. Research shows variable impacts. Some stations command premiums while others show minimal or negative effects.

Evaluate whether transit represents genuine improvement over existing service. Assess actual walkability and development trajectory around stations. Remember projects historically experience delays, so plan for extended timelines rather than optimistic projections.

Ready to develop a fact-based strategy?

Contact SJA Property Management for market analysis based on documented data, verified timelines, and realistic expectations. Our approach helps investors identify genuine opportunities while avoiding speculative assumptions.

Continue expanding your investment knowledge with our evidence-based market analysis and strategy resources.